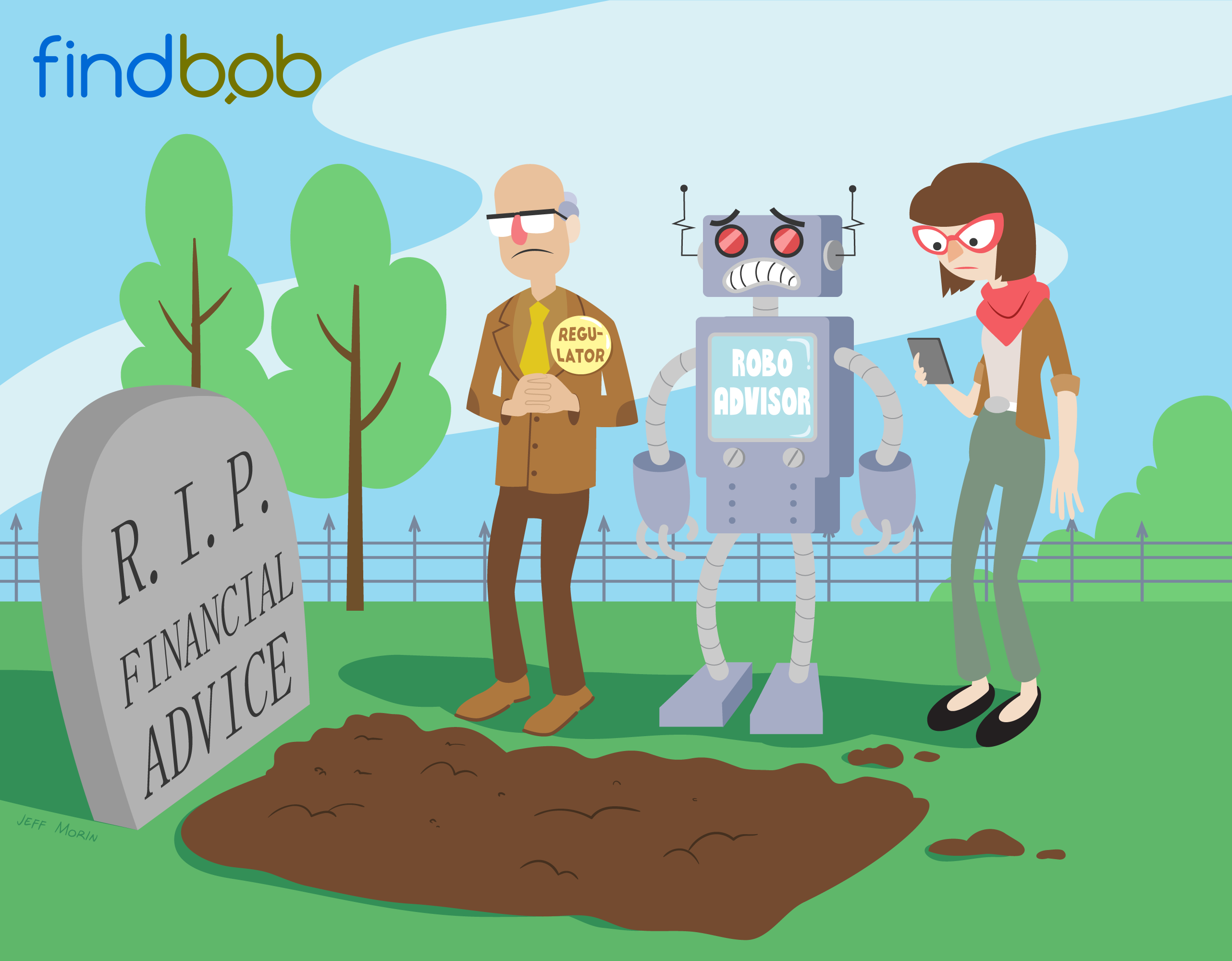

Take down that shingle, advice is dead. An aging demographic, increasing regulatory oversight, unending media scrutiny, and of course there’s the fintech revolution. In a nutshell, why talk to a stodgy old advisor when you can already manage your low fee retirement account, purchase term insurance and get a loan all while you’re in line at Starbucks?

It’s because advice matters.

The business case for financial advice is well documented. In 2014 PwC conducted a comprehensive study on the value of the independent financial advisor to Canadians. It revealed, among other things, that the advice we are providing is primarily to those individuals with lower levels of investable assets. Given that 80% of Canadians have less than $100,000 in investable assets, and that the average Bank-owned full service brokerage customer has an average of $430,000 in assets to invest, it’s quite evident who is benefiting from the financial advice given by independent advisors: pretty much everybody.

Not only are clients who work with advisors reportedly happier with their financial life, but according to another report advised households have 4x as many assets and saved 2x more than households without financial advice. Advisors aren't just product pushers. They're coaches. From market volatility to assessing cash flow needs, advisors ensure the ephemeral issues don't deviate clients from their long term goals.

In fact, the independent financial advice segment of financial services employs over 182,000 Canadians and generates a whopping $19 billion in GDP. Let’s put that in perspective: the financial advice industry in Canada has a direct economic impact that is larger than the contribution of either the Pharmaceutical sector, Motor Vehicle Manufacturing, or the Aerospace industry.

Amidst all the significant changes going on in their industry, advisors are reportedly satisfied and optimistic about their future and their client's feel that they are better off because of them.

So if Advice is "Dying", What’s Really Killing It?

Lack of next generation talent, absence of planning for their practices future, anemic support from their firms, along with complexity and inefficiencies in a market designed for single-owner practices to fail. That's what.

1. No new blood.

With all this talk about raising the professional bar I often ask myself: “Who are we raising the bar for?”. According to GAMA, only 1 out of every 10 advisors will make it past their 4th year in the business. You’d think as an industry we’d be doing our best to increase the size of that funnel and be recruiting like crazy. We’re not, and we need new blood. We need to do a better job in grooming the next generation of talent. Equally as important we need to provide meaningful opportunities to high potential advisors and agents to help succeed and grow their practices.

2. No planning.

Clients aren’t the only ones aging. Their advisors are aging just as fast as they are. The average age of the financial advisor is 50 and the average age of the independent financial advisor is 59. In our research we found that over 80% of advisors don’t have written and actionable succession plans. What’s worse is that over 90% don’t have a continuity plan in the event of death or disability. It’s not that we’re doing a poor job at planning as an industry, it’s that we’re not planning for succession at all. As a result, advisors are riding their practices into the sunset, hanging on for dear life in the hopes clients don’t discover that we don’t practice what we preach. Even the best laid plans can go awry, so it's best to start early and iterate often.

3. No support.

A 2013 John Hancock study revealed that over 81% of advisors felt that the industry did a poor job in supporting their succession. In fact, in a 2016 study, support from their firm with respect to transition and succession was cited as one of the top categories of importance to advisors working at brokerages, dealers, insurance agencies as well as banks. It’s clear that firms who provide this type of support will have a distinct advantage over those who don’t.

4. No know how.

The John Hancock study also revealed that lack of knowledge about important aspects of succession planning most important to them was one of the major barriers to participating in transition. How ironic that the very people who for a living, go out into the community to advise on continuity and transition planning to families and small business owners simply don’t feel confident enough to do it for themselves. We’re the dentist with bad teeth.

5. Nowhere to look.

Advisors looking to sell or find a successor cite “not being able to find an adequate” partner as the number one barrier they’ve encountered. Given that it is a seller’s market and that reports indicate a 50:1 buyers for every seller, it really shouldn’t be that difficult finding your practice’s next generation. Yet, due to lack of support from their firms, and for a variety of interpersonal and psychological reasons, advisors aren’t managing to find individuals they feel comfortable handing over the reins too.

All of the above point to structurally inefficient practices that aren’t built with endurance in mind. Advisors books of business, their most precious asset, are in danger of eroding due to attrition. However, they're not the only ones in danger. Clients are being left in the lurch too. You see, when these practice owners initially engaged their clients they did so with the purpose of looking after their family and business' financial well being for the course of the client’s lifetime – not only the length of the practice owner’s career. Practices not built to last are grossly ignoring their fiduciary obligation.

4 Things to Resurrect the Marketplace

1. Focus on advisor outcomes

Firms would serve themselves well by helping advisors focus on transition outcomes. Treating advisors much in the same way we treat clients is just what the doctor ordered. Focusing on advisor needs and getting laser-like on what their vision and goals are, regardless of what stage they are in their practice today, will help craft a roadmap for the future that will benefit not only the advisor but the firm as well. Not to mention the important dialogue that should be had about the client’s future.

2. Streamline firm’s transition processes

It’s clearly no longer acceptable for firms to ignore the growth and transition goals of advisors. Having sales management, who aren’t motivated to help advisors succeed in the area of transition & growth, isn't an optimal use of resources, nor is it scaleable. Firms need to get serious about truly listening. Moreover, they need to increase efforts in the area of underwriting the risk and the impact of loss for the practices within their distribution so they can properly prioritize business objectives. Relationship managers can then be tasked with supporting their advisors with meaningful actions that support advisor needs. Read on.

3. Provide actionable steps

Once an advisor’s practice goals have been identified focusing on actionable steps to achieve those goals becomes the next priority. Firms should provide education and resources like “how to establish a continuity plan”, “how to buy a practice” or “how to obtain a professional valuation”, which answer commonly asked questions by advisors. By demystifying the steps required to achieve their goals advisors will become increasingly confident and motivated to take action. After all, succession planning isn’t a one-time event, it’s a development process.

4. Highlight internal opportunities

The fact that advisors are have difficulty sourcing other advisors who could be a partner in transition - whether it be buying, selling, merging, partnership, succession or continuity - illustrates that there are some huge inefficiencies in the marketplace. Firms and institutions should make it easier for advisors, who are relationship-focused individuals, to safely and anonymously discover one another based on their interests. Should advisors discover opportunities within their own organization’s walls, that will surely provide some added assurance that business will remain within their firm, and that the consumer and advisor will be afforded a seamless transition. Once this facility is established, recruiting to opportunities also becomes an effective way to entice next generation advisors to join the business.

These are the problems Find Bob solves. As the leading provider of transition management solutions for the financial services industry, Find Bob’s mission is to ignite transition behaviour within companies that have growth conscious cultures by aligning both firm and advisor interests - for every firm in the world. Our platform provides meaningful tools and education to help advisors make steady and intentional progress towards their goals, enables firms to strategically analyze and manage transition & growth opportunities, and offers a private marketplace to facilitate internal transitions.

We’re so excited to finally be writing about our journey with you here, and know that the work we collectively do, will help protect an industry we love. The consumers who benefit from our advice deserve it. Stay tuned as we share expert tips from our advisors and enterprise customers, interviews with industry influencers, product updates and our startup journey. Welcome to Find Bob.