Yesterday, we had the wonderful opportunity to work with our partners at Grinnell Mutual to bring their national network of agents and agencies session one of SUCCESSion Academy: Introduction to Business Continuity - a webinar focused on introducing agents to business continuity planning.

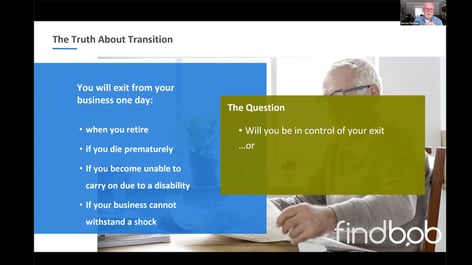

Hosted by FindBob’s Chief Practice Management Officer and CEO of Market Logics, George Hartman, agents learned about the importance of having a business continuity plan, the difference between succession and business continuity, the value of having a business continuity plan, and the continuity planning process.

For agents and advisors who don’t have a business continuity plan, right now is the best time to start working towards one. Establishing a business continuity plan during a global pandemic shows your customers that you’re thinking about them and you have their backs.

How do you want your clients to remember you post-pandemic?

Most likely, you want to be remembered as the agent or advisor who was well-prepared for the unexpected. The business whose clients were still receiving a high level of service and attention, and who knew they were in good hands because you proactively made the decision to protect your business and your clients with a business continuity plan.

Not only do your actions during this global disaster help preserve and enhance your business’s reputation, but if you take the right steps, you’ll be strategically setting yourself up to receive referrals from your customers. Right now is the time customers are deciding if they picked the right business for their needs or if they should take their business elsewhere.

During the webinar, we also shared how a FindBob feature - the Business Continuity Builder - helps agents and advisors become educated on business continuity, find a continuity partner, file a written contingency agreement with their enterprise, and develop a working business continuity plan. The tool, which is currently exclusively available on our white-labelled platforms, takes the guess-work out of the planning process and breaks the process down into five easy steps. It includes an agreement template and a step-by-step plan writer. Once completed, an agent or advisor will have developed a tangible business continuity plan.

Recent events have demonstrated the undeniable need for every business to have a continuity plan. As a company, we've been championing business continuity since our inception. Quite frankly, it's our mission: to encourage better transition behaviour in our industry. Business continuity and preparing for the unexpected is an essential part of that. We want to make sure agents and advisors have the tools and resources they need to address business continuity within their own businesses.

If you're an agent or advisor working with one of our enterprise partners and would like to learn more about our DIY Business Continuity Builder that will help you build a robust plan, reach out to your carrier, dealer or MGA or feel free to email us at success@findbob.io to learn more.