Valuation has always been a hot topic in the industry. And now more than ever, since agents are concerned about how the pandemic will impact the value of their businesses.

For Session two of Grinnell Mutual's SUCCESSion Academy, we were joined by Mercer Capital’s Vice President, Lucas Parris, for “Valuing an Insurance Agency”. Parris gave us a detailed overview of the industry landscape and trends, he broke down the different valuation methods used to value insurance agencies, and of course, he discussed what we all want to know, how COVID-19 is impacting agency valuations.

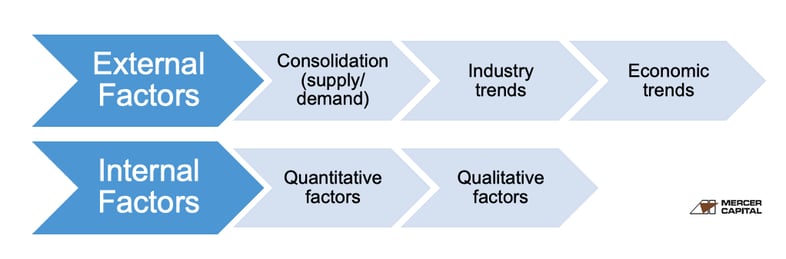

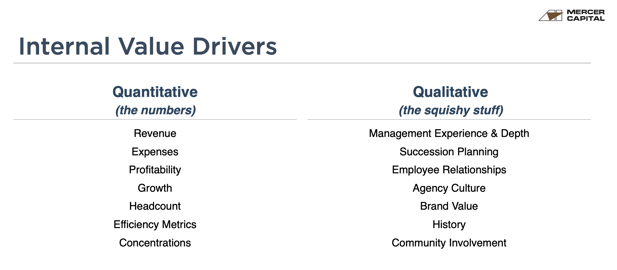

To understand how the pandemic may impact the value of an insurance business, we need to understand what goes into creating an agency's value. There are both internal and external factors at play, and while we don’t have control over the external factors, we may have some level of control over the internal ones.

The efforts you put into your agency over the years, the reputation you built, the team you chose, and your strengths as a manager all impact the value of your business. Most of these are not dependent on the market. Coupled with a contingency plan, these efforts will have built a certain level of resiliency within your business to help mitigate loss in value and even help build value post-pandemic.

We also need to assess COVID-19’s impact on a business’ cash flows, as well as its risk factors and growth potential.

The impact on cash flows will vary from business to business. Some businesses may be only slightly impacted, or even not at all, while others may be seeing a decline in cash flow directly tied to the pandemic. For P&C firms, this can look like fewer exposure units and reduced coverage. At the extreme, it can look like cancelled policies or clients’ inability to keep up with premiums.

Luckily, the characteristics of the insurance industry are what encourage consolidation, such as low capital intensity, recurring revenue stream model, high cash flow margins and scalability. Insurance is still a necessary product, so the industry risk is still relatively low. However, some agencies, like those who have product concentrations in heavily affected industries may be associated with a higher risk factor.

An agency’s product lines, geographic location, and its pre-pandemic adaptations (like technology integrations), will determine how quickly an agency can recover and be an indication of its growth potential to potential buyers.

Though no one can see into the future, the horizon for insurance businesses looks promising and Mercer Capital predicts the industry will still be favourable for many participants, including the independent agent.

Agents and advisors on participating white-labelled FindBob platforms have access to our proprietary valuation tool which provides them access to three different valuation methods for their business: Multiple of Revenues, Multiple of Cash Flows, and Discounted Cash Flows.

Platform users will receive three different business valuations, and depending on their business structure, they can determine which one is most suitable for them.

Our valuation tool, while it’s for educational purposes only, provides agents and advisors a starting point to understanding their business’s value and what factors influence that value. Knowing the value of your business is important so you can monitor how that value changes year over year.

We recommend agents and advisors preparing to transition their business to a new owner in the next five to seven years learn the value of their business by receiving a valuation from a firm like Mercer Capital so they can monitor the impact of the current pandemic on their business and take the necessary steps to start rebuilding that value before the transition.