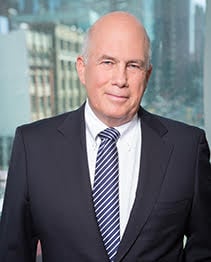

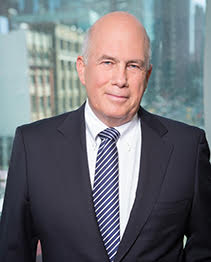

David A. Gray joins us in our newest addition to the Influencers Series with FindBob. David is known as The Builder, from his commendable reputation building businesses up from very little. David has an amazing way of focusing on the right processes, communicating very clearly, and motivating people to achieve desired results. With over 40 years of experience within the industry, and a track record of successful building, both within businesses and through leading teams, David has gained immensely valuable expertise which we will be tapping into today in our short interview.

David A. Gray joins us in our newest addition to the Influencers Series with FindBob. David is known as The Builder, from his commendable reputation building businesses up from very little. David has an amazing way of focusing on the right processes, communicating very clearly, and motivating people to achieve desired results. With over 40 years of experience within the industry, and a track record of successful building, both within businesses and through leading teams, David has gained immensely valuable expertise which we will be tapping into today in our short interview.

In our exchange with David, we will be focusing on transition and succession planning, looking to David for some insights into these topics as he has experienced them with over 40 years in the industry. Throughout our Q&A, David provides many relevant points to think about, including the just how large of a threat the succession problem poses to our industry, and advice for how one should approach their own succession. Read on to see what David A. Gray has to share about the succession problem and more.

FindBob: According to industry reports, the average age of the independent advisor is 59. Over 80% of these advisors don’t have a written and actionable succession plan. What, in your opinion, are the major barriers preventing advisors from taking action?

David A. Gray: In many cases the advisors simply do not know what to do or have a process to follow that is directive and simple to follow. This makes it easier to do nothing and put it off until later.

FindBob: That’s certainly something that we have noticed as well. When we first met you made a very profound statement that the “industry lacked streamlined processes to help advisors with succession unlike other aspects of our profession”.

David A. Gray: The majority of independent advisors grew up in the career system and most were provided with what I would refer to as "the book" to follow. The companies had professional development, education, and support teams to develop and organize most aspects of an advisor’s career. Today there are only a few companies that continue to have their own advisor career system and the support mechanisms I'm referring to, Sun Life is one of them. The MGA's are all trying to figure it out on their own or in conjunction with CAILBA, but it takes time, resources and money.

FindBob: With that being said, what can firms do to assist advisors to prepare for succession events and ensure that they make the winning pick when the time comes?

David A. Gray: In my opinion it is always most prudent to access the advice and help of experts in their field. The topic of Succession is one of the hottest topics in the industry today and there are many firms and experts that are making themselves available to help. Understanding what the "experts" can offer, and in turn bringing that expertise to the table to support the education needed by advisors to better understand all aspects of succession, would be a good first step.

FindBob: After an Advisor takes that first step by consulting an expert, what recommendations do you have for maximizing the value of their practice prior to putting it on the market?

David A. Gray: Get educated on what is involved in building a succession plan and how it will affect your current and future business. You cannot afford to miss a step along the way, as the consequences of making uninformed decisions, greatly increases the risk to you on achieving your succession goals.

FindBob: Other than the business and financial considerations of succession planning, there is the more emotional side of parting with such a huge aspect of an Advisor’s life. On that note, what advice do you have to advisors to help them prepare themselves both emotionally and financially for succession?

David A. Gray: I would ensure that I dealt with the emotional preparation up-front to determine not only how it would affect the selling advisor and the go forward plan, but also to ensure that the right buyer is being put in place to ensure a smooth transition for the clients and the business.

FindBob: David, you’re so passionate about this problem. Any parting thoughts you’d like to share?

David A. Gray: This problem exists throughout North America and it is a threat to the industry. We can do for clients what many other industries cannot do, and that is to help them achieve their goals of financial security and well being, through sound advice. If we do not start to think differently about succession across the industry, including the development of new advisors, as well as finding ways to provide ongoing advice to the clients of retiring advisors, then we may be challenged to deliver the client experience we set out to deliver, and we risk delivering on the valuable services that are needed by many.

Thank you David for being part of our Influencers Series! We hope that you enjoyed reading what David has to say about transition and succession planning. Part of what we do at FindBob is focus on providing education and tools to Advisors so they can feel better equipped at tackling their succession and not have to go at it alone. Just as David expressed, the first step is the hardest to take, and when Advisors do not even know where to begin, it becomes easier to prolong beginning the succession planning process.