The Next 6 Lessons

Anyone who’s been around long enough knows that real life is often the most effective teacher. Working in the insurance industry is no exception; the job has a lot to teach us over time.

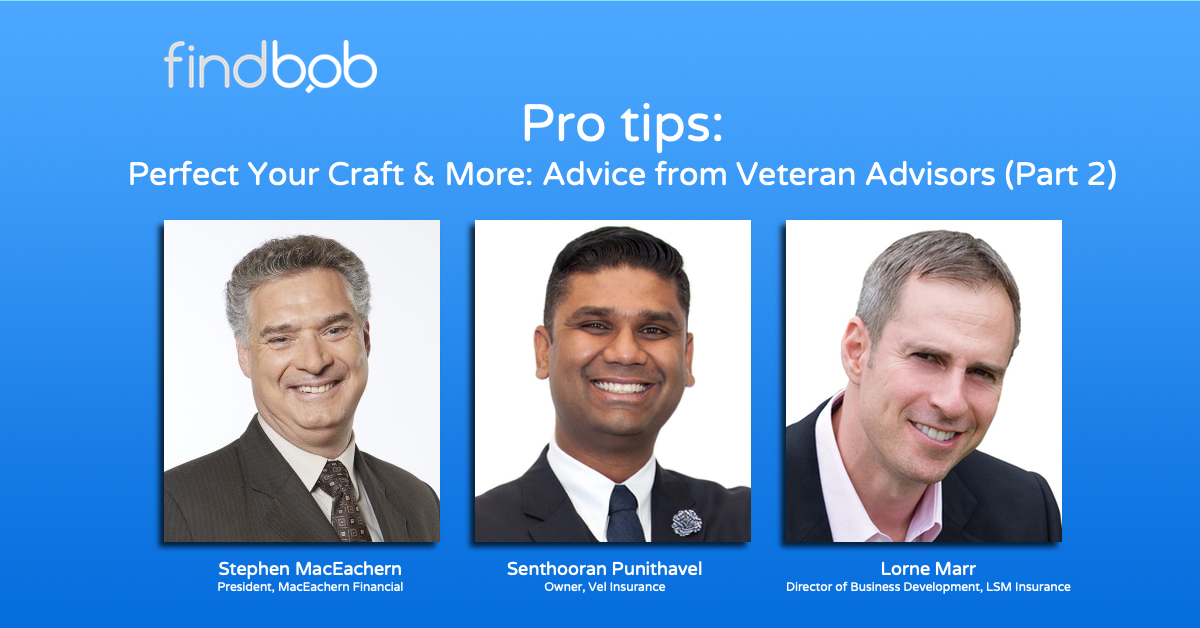

The following is part two of our master class with Lorne Marr, Senthooran Punithavel and Stephen MacEachern. (Marr is director of business development for LSM Insurance. Punithavel is an agent and owner with the Cooperators Group, and MacEachern is head of Stephen MacEachern Insurance & Financial Services.) Combined, the three have well over 60 years of experience working as life and health and property casualty advisors.

Did you miss part 1? Click here to read Pro tips, part 1: 12 lessons for life in the insurance industry.

Here’s part 2 of the advice they have for advisors who want to improve their business:

1. Perfect your craft. (Work on it.) “I’m always trying to perfect my craft,” Marr says. “I’m always trying to find ways to do things better, to make myself more efficient, more professional, to make myself a better listener. It’s constant learning. It’s really about developing your craft, learning to overcome rejection and build from that rejection. There’s always going to be a lot of failure along the way with any goal you’re trying to achieve.”

2. Set short term, medium-term and long-term goals. “If you don’t have a goal and you don’t write it down, it’s very unlikely that you’re going to achieve what you want to achieve,” he adds.

3. Get your family involved. “When I set my goals, especially early in my career when my kids were smaller, I always got my family involved in the process,” Marr says. Like most agents, there were a lot of evening meetings to attend when he was a new agent with a young family. Tying his own work to family goals by pointing out that the family can enjoy certain activities together if work goes well, he says really allows the whole family to get on board.

4. Create a good headspace for yourself. Marr recommends that anyone, but agents and advisors in particular, can benefit from reading or listening to something positive for ten minutes every morning and for five minutes at night before going to bed. “I call it the ten-five rule,” he says. “The very nature of sales is that there’s going to be a lot of rejection. If you can start off your day with a good mindset and finish your day with a good mindset, it really allows you to have a more productive day. It increases the likelihood of that.”

5. Under-promise and over-deliver. “It’s even more important now, in today’s online world, because people can review you, share, and spread the word by social media so quickly. If you’re doing a poor job, it can really wreak some havoc on your image and your ability to earn a living,” he adds.

6. Don’t focus on the money. “When I started this whole insurance thing, I came in as a very type-A sales person. Over the years I’ve really mellowed out. I started saying ‘it’s not about the money, it’s about the people,’ when I started doing that, I realized I made more money,” Punithavel says. “When I came in here, I came in for the money but then I realized it wasn’t my number one priority. My number one priority was doing things the proper way. That in turn actually made me more money in the long run.”

Interested in reading more on finding balance in this industry? Read our article on Finding Balance.